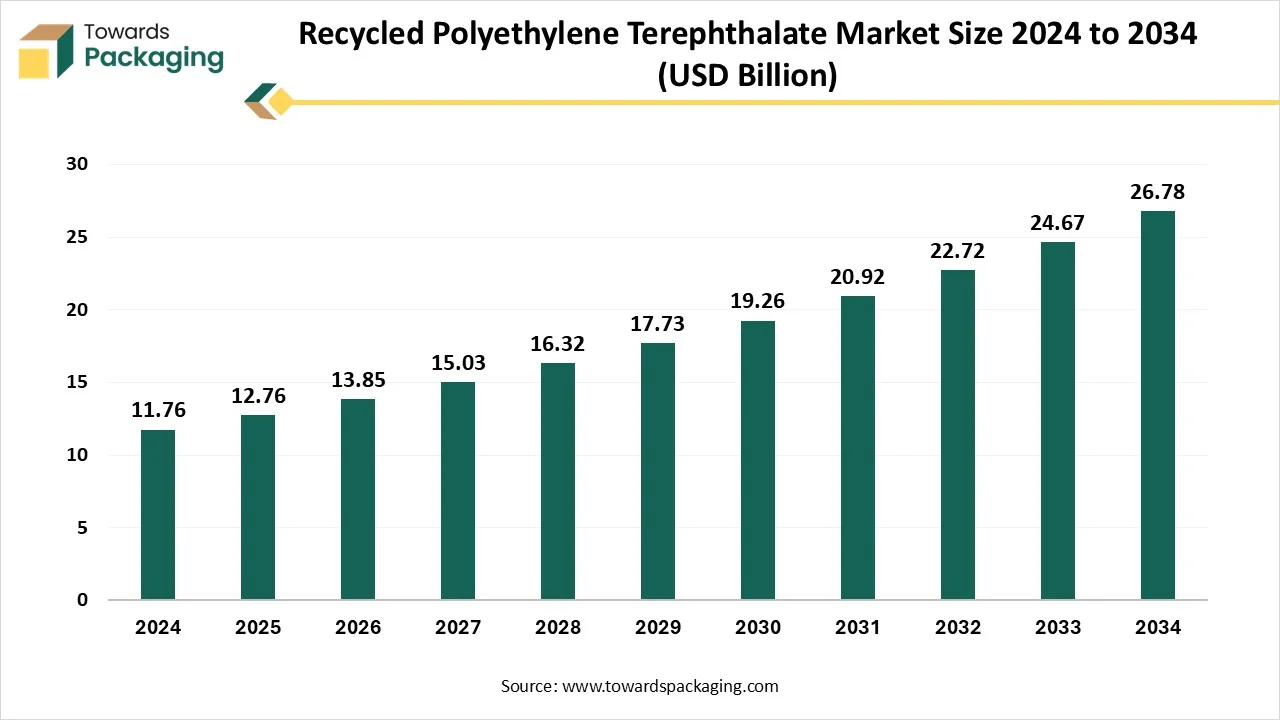

Recycled PET rPET Market 2025 on Track for USD 26.78 Billion by 2034 Amid Green Push

According to Towards Packaging consultants, the global recycled polyethylene terephthalate (rPET) market is projected to reach approximately USD 26.78 billion by 2034, increasing from USD 11.76 billion in 2024, at a CAGR of 8.53% during the forecast period 2025 to 2034.

Ottawa, Aug. 07, 2025 (GLOBE NEWSWIRE) -- The global recycled polyethylene terephthalate (rPET) market size stood at USD 12.76 billion in 2025 and is projected to reach USD 26.78 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5649

The market is experiencing robust growth driven by increasing environmental awareness, government regulations promoting plastic recycling, and rising demand for sustainable packaging solutions. Industries such as food and beverage, personal care, and textiles are widely adopting recycled polyethylene terephthalate (rPET) due to its cost-effectiveness and reduced carbon footprint.

Technological advancements in recycling methods, such as mechanical and chemical recycling, are enhancing the quality and application range of rPET products. Additionally, growing consumer preference for eco-friendly and recyclable products is encouraging manufacturers to shift toward rPET-based packaging. The market is also benefiting from corporate sustainability initiatives and collaborations focused on building circular economies.

What is Recycled Polyethylene Terephthalate (rPET)?

Recycled polyethylene terephthalate is a type of plastic material that is produced by recycling used PET (Polyethylene Terephthalate) products, such as water bottles, food containers, and other consumer packaging. PET is a lightweight, strong, and clear plastic commonly used in packaging because of its durability and safety. When these products are collected and processed through mechanical or chemical recycling methods they are transformed into rPET which can be reused in manufacturing new packaging materials.

rPET significantly helps reduce plastic waste and reliance on virgin plastic, making it a more sustainable alternative. In packaging, rPET retains the same functional benefits as PET, such as strength, clarity, and resistance to moisture, while contributing to lower environmental impact. It supports circular economy practices, reduces carbon emissions, and meets the rising consumer and regulatory demand for eco-friendly packaging solutions.

What Are the Latest Trends in the Recycled Polyethylene Terephthalate Market?

Regulatory mandates tighten fast: Governments, including the EU and India, are enforcing stricter minimum recycled content and deposit schemes, forcing brands to adopt rPET or risk non‑compliance fines.

Virgin PET undercuts rPET: With oil prices low and subsidies in place, cheapest virgin PET remains hard to beat, rPET loses price competitiveness unless scaled efficiently.

Contamination chaos in feedstock: Poor segregation infrastructure and mixed waste streams result in quality issues that limit rPET’s usage in food‑grade packaging.

Discoloration dents consumer trust: Tinted, inconsistent, or murky rPET scares consumers even when functionally safe, undermining brand credibility.

R&D dependency grows: Chemical and molecular recycling innovation is essential to address quality and feedstock limitations, but requires massive capital investment and time.

Bottle‑to‑fabric competition intensifies: Demand from textile fiber makers (e.g., Repreve) is pushing rPET supply away from bottle‑to‑bottle recycling, driving up feedstock costs.

Textile recycling threatens scale: The push toward textile‑to‑textile recycling may fragment rPET availability for packaging unless policy aligns feedstock flows.

Enzymatic and advanced chemical recycling rise

The commercialization of enzymatic PET recycling (e.g., Carbios in France) enables closed-loop recycling of colored or multilayer plastics, traditionally unrecyclable by mechanical methods.

Micro‑recycling facilities

Demand surges for decentralized micro-processing hubs and AI-powered optical sorting to improve feedstock purity, reduce contamination, and enable rural access.

Color-specific rPET for brand differentiation

Upgraded near-infrared sorting and specialized color additives now support neon and custom‑tinted rPET lines for aesthetic packaging and decorative applications.

Supply diversification to non‑packaging and textile applications

Expanded rPET usage in automotive interiors, electronics casings, home goods, and textile fibers (e.g., Repreve), creating both positive demand and potential supply competition.

Infrastructure scale-up in emerging markets

Governments and brands in Asia-Pacific, India, and Africa are investing heavily in collection systems, recycling networks, and regulatory mandates, for example, India’s FSSAI and recycled content rules starting April 2025.

Digital traceability and supply chain transparency

Blockchain and QR-based tracking systems are becoming common to authenticate recycled content and combat contamination, empowering consumers and regulators.

Corporate circularity and collaborations intensify.

Major players like Indorama Ventures, Coca‑Cola, PepsiCo, and TotalEnergies are forming alliances, launching circular‑hub plants, and committing to high rPET content in packaging.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is the Potential Growth Rate of the Recycled Polyethylene Terephthalate Market?

-

Environmental awareness and consumer pressure

Growing concerns about plastic pollution are pushing consumers and businesses toward sustainable packaging alternatives. This demand is fueling widespread adoption of rPET, especially in food, beverage, and personal care products.

-

Government support and regulatory mandates

Governments worldwide are enforcing policies like minimum recycled‑content mandates, deposit return schemes, extended producer responsibility (EPR), and procurement rules to boost rPET use in packaging.

-

Corporate sustainability commitments

Major brands such as Coca‑Cola, PepsiCo, Nestlé, Unilever, Evian, and others have pledged to incorporate significant recycled content in packaging, creating consistent, large-scale demand for rPET.

Limitations and Challenges in the Recycled Polyethylene Terephthalate Market

Limited Availability of High-Quality Feedstock and Quality and Performance Limitations

The key players operating in the market are facing issues due to quality limitations and limited availability of high-quality feedstock. Contamination in post-consumer plastic waste (like food residues, mixed materials, and colors) makes it difficult to obtain clean PET for recycling, especially for food-grade applications. Virgin PET is often cheaper to produce, especially when oil prices are low, making rPET less economically attractive without subsidies or mandates, particularly in cost-sensitive markets.

Recycled PET may show inferior mechanical properties, such as reduced strength and clarity, which limits its use in high-end or technical applications like pharmaceuticals or premium packaging. In many regions, particularly developing countries, recycling infrastructure is underdeveloped. Poor collection systems and limited technology reduce rPET availability and quality.

More Insights of Towards Packaging:

- Multilayer PET Bottles Market - The multilayer PET bottles market is forecast to grow from USD 10.73 billion in 2025 to USD 18.02 billion by 2034, driven by a CAGR of 5.93% from 2025 to 2034.

- PET/EVOH/PE Packaging Materials Market - The global PET/EVOH/PE packaging materials market is expected to increase from USD 197.64 million in 2025 to USD 281.79 million by 2034.

- PET Packaging in Pharmaceutical Market - The PET packaging in the pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Leak-Proof Flexible Packaging Market - The leak-proof flexible packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- North America Packaging Market - The North America packaging market is forecasted to expand from USD 333.86 billion in 2025 to USD 488.92 billion by 2034, growing at a CAGR of 4.33% from 2025 to 2034.

- Glass-to-Plastic Packaging Market - The glass-to-plastic packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Recycled Packaging for Apparel Market - The recycled packaging for the apparel market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Cellulose Film Packaging Market - The cellulose film packaging market is forecast to grow from USD 940.11 million in 2025 to USD 1532.98 million by 2034, driven by a CAGR of 5.63% from 2025 to 2034.

- Sustainable Minimalistic Tableware Packaging Market - The global sustainable minimalistic tableware packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Stretch Wrap Packaging Market - The global stretch wrap packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

Regional Analysis:

Who is the Leader in the Recycled Polyethylene Terephthalate Market?

Asia Pacific dominates the recycled polyethylene terephthalate market due to several key factors. Rapid urbanization, rising population, and increasing consumption of packaged food and beverages have led to high PET usage and a growing demand for sustainable packaging. Countries like China, India, and Japan have established large-scale recycling infrastructures and are investing heavily in advanced recycling technologies.

Government initiatives promoting plastic waste reduction and circular economy practices further support market growth. Additionally, the presence of major textile and packaging industries in the region boosts demand for rPET in various applications, including fabrics and containers. Cost-effective labor and manufacturing advantages also make Asia-Pacific a global hub for rPET production and export, contributing to its dominant market position.

China Market Trends

China is the largest consumer and producer of rPET in Asia-Pacific. The country has an extensive plastic collection and recycling network, supported by government initiatives aimed at reducing plastic waste. China's vast textile industry also drives demand for rPET fibers. Despite the "National Sword" policy banning foreign waste imports, domestic recycling has grown stronger and more regulated.

India Market Trends

India is rapidly emerging in the rPET market due to its growing packaged goods sector, supportive recycling regulations (e.g., Extended Producer Responsibility), and rising environmental awareness. The Food Safety and Standards Authority of India (FSSAI) now allows the use of rPET in food packaging, boosting local demand and domestic recycling efforts.

Japan Market Trends

Japan has one of the highest PET bottle recycling rates globally, exceeding 85%. The country excels in waste segregation and uses advanced recycling technologies. Strict environmental regulations and strong consumer participation support its rPET market. Japan also exports high-quality recycled resin, especially for textile and packaging use.

South Korea Market Trends

South Korea has a well-structured waste management system and is investing in high-tech recycling solutions. Its focus on smart cities and sustainable development encourages greater use of rPET, particularly in consumer goods packaging and electronics.

Indonesia Market Trends

Indonesia is expanding its rPET capacity with foreign investments and public-private partnerships. Initiatives such as the National Plastic Action Partnership aim to reduce ocean plastic and improve plastic circularity, helping Indonesia grow as a key rPET player in Southeast Asia.

How is the Opportunistic Rise of North America in the Recycled Polyethylene Terephthalate Market?

North America is the fastest-growing region in the recycled polyethylene terephthalate market due to strong regulatory support, rising consumer demand for sustainable products, and increasing investment in advanced recycling technologies. Governments and states are implementing strict policies on single-use plastics and promoting minimum recycled content in packaging.

Major brands are committing to circular economy goals, driving up the demand for rPET in food, beverage, and personal care industries. Additionally, the region benefits from improved recycling infrastructure, public-private partnerships, and innovation in chemical recycling methods, which enhance the quality and versatility of rPET, accelerating market growth across various sectors.

U.S. Market Trends

The U.S. leads rPET market growth in North America, driven by aggressive sustainability goals from large corporations like Coca-Cola, PepsiCo, and Nestlé USA, which are pushing for higher recycled content in packaging. Multiple states, such as California and New York, have enacted laws requiring minimum percentages of rPET in beverage containers. Investments in advanced mechanical and chemical recycling facilities, along with support from the U.S. Environmental Protection Agency (EPA), are accelerating innovation. Consumer awareness and demand for eco-friendly products further boost rPET usage across industries.

Canada Market Trends

Canada is rapidly advancing in plastic waste reduction policies, especially through its Zero Plastic Waste initiative and national ban on certain single-use plastics. Provinces like British Columbia and Ontario have strong Extended Producer Responsibility (EPR) frameworks, encouraging companies to incorporate rPET in their products. Canadian retailers and brands are also shifting toward circular packaging, increasing domestic demand. The government's collaboration with recycling companies to enhance infrastructure and technology further strengthens Canada's rPET market growth.

How Big is the Success of the European Recycled Polyethylene Terephthalate Market?

Europe is experiencing notable growth in the recycled polyethylene terephthalate market due to stringent environmental regulations, strong political commitment to sustainability, and widespread consumer demand for eco-friendly packaging. The European Union’s directives, such as the Single-Use Plastics Directive and the Packaging and Packaging Waste Regulation, mandate minimum recycled content in plastic bottles and promote a circular economy. Countries like Germany, France, and the Netherlands have highly efficient waste collection and sorting systems that ensure a steady supply of high-quality PET waste for recycling.

Many European brands and retailers are committing to carbon-neutral goals and incorporating more rPET in their products. Investment in advanced recycling technologies and cross-border recycling collaborations further supports market growth across the region, making Europe a leader in sustainable plastic innovation.

How Crucial is the Role of Latin America in the Recycled Polyethylene Terephthalate Market?

Latin America is growing at a notable rate in the recycled polyethylene terephthalate market due to increasing awareness about plastic pollution, rising demand for sustainable packaging, and supportive government initiatives. Countries like Brazil, Mexico, and Chile are leading the way with strong bottle-to-bottle recycling programs and partnerships between private companies and local governments. The expansion of collection systems and investment in recycling infrastructure are improving the quality and availability of PET feedstock.

Major global beverage and consumer goods companies operating in the region are committing to sustainability targets, driving demand for rPET. Growing participation from informal recycling sectors and public education campaigns is also helping improve recycling rates, making Latin America an emerging and important player in the global rPET market.

How does the Middle East and Africa lead the Recycled Polyethylene Terephthalate Market?

The Middle East and Africa (MEA) presents a rising opportunity for the recycled polyethylene terephthalate market, thanks to growing consumer demand for packaged goods, expanding recycling infrastructure, and supportive government initiatives. Rapid urbanization and rising disposable incomes, particularly in Saudi Arabia, UAE, and Egypt, are fueling demand for bottled beverages and on‑the‑go food products, driving rPET uptake in packaging.

Governments in the Gulf, including the UAE’s Circular Economy Policy and Abu Dhabi’s “Mission to Zero,” are incentivizing rPET adoption through regulations, certification schemes, and reverse vending systems. Major recycling collaborations, such as partnerships involving Veolia, Bee’ah, and Agthia, plus investment in new food‑grade rPET plants, are strengthening local capacity and supply stability. Meanwhile, Saudi Arabia is leading regional growth, backed by substantial funding and new recycling facilities targeting high post-consumer PET volumes.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Source Insights

The bottles and containers segment is the dominant part of the recycled polyethylene terephthalate market because of its high demand in the food, beverage, and personal care industries. rPET is widely used to make water bottles, soft drink containers, and packaging for shampoos and detergents due to its strength, clarity, and safety for food contact. With increasing environmental concerns, many brands are choosing rPET for packaging to reduce plastic waste and meet sustainability goals.

The films and sheets segment is the fastest-growing part of the recycled polyethylene terephthalate market due to its increasing use in packaging, agriculture, construction, and electronics. rPET films and sheets are lightweight, strong, and recyclable, making them a popular choice for flexible packaging, protective coverings, and insulation materials. Many industries are switching to rPET-based films to reduce plastic waste and meet sustainability targets.

In food packaging, rPET sheets help keep products fresh while being safe for contact with food. The demand is also growing in electronics and automotive applications where clear, durable, and cost-effective materials are needed. As more companies and governments support eco-friendly materials, rPET films and sheets are being used more widely, driving rapid growth in this segment.

Grade Insights

The Grade A segment is the dominant part of the recycled polyethylene terephthalate market because it offers the highest quality and purity. It is mostly used in food and beverage packaging since it meets safety standards for direct contact with food. Grade A rPET is clear, strong, and looks almost like new plastic, making it ideal for making bottles and containers. Many global brands prefer Grade A rPET to meet their sustainability goals while maintaining product quality and safety.

The Grade B segment is the fastest-growing part of the recycled polyethylene terephthalate market because it is more affordable and suitable for non-food applications. It is commonly used in textiles, strapping, automotive parts, and construction materials where high purity is not required. As demand rises for cost-effective recycled materials in these industries, Grade B rPET becomes a popular choice. Its growing use in developing countries and for industrial purposes is helping this segment expand quickly in the global market.

Form Insights

The rPET flakes segment dominates the recycled polyethylene terephthalate market due to its versatility, cost-effectiveness, and widespread application across various industries. These flakes are easy to produce and are widely used in manufacturing packaging materials, textile fibers, and automotive components. Their compatibility with existing production systems makes them a preferred choice for manufacturers seeking sustainable alternatives.

Additionally, growing environmental regulations and consumer demand for eco-friendly products have increased the adoption of rPET flakes. Their consistent quality, recyclability, and availability further contribute to their dominance, making them a critical component in the global shift toward circular economy practices.

The rPET chips segment is the fastest growing in the recycled polyethylene terephthalate market due to its high purity, superior quality, and increasing demand in high-end applications such as food-grade packaging and beverage bottles. These chips undergo advanced recycling processes, making them suitable for direct contact with consumables, aligning with stringent safety and regulatory standards. The rising emphasis on sustainability by major consumer goods companies is also driving demand for rPET chips. Additionally, technological advancements in bottle-to-bottle recycling and strong support from government initiatives promoting circular economy practices further accelerate the growth of this segment in the global market.

By Product

The clear segment is the dominant segment in the recycled polyethylene terephthalate market because clear PET is easier to recycle and retains a higher value after processing. It allows for greater flexibility in reuse, especially in food-grade applications, as it can be more easily converted into new clear or colored products. Clear rPET is widely used in the production of beverage bottles, containers, and packaging films because it provides a clean, transparent appearance that appeals to consumers and maintains product visibility.

Brands prefer clear rPET as it closely resembles virgin plastic in both look and quality. Additionally, the recycling process for clear PET requires fewer additives and less processing than colored PET, making it more efficient and cost-effective, further supporting its dominant market position.

The colored segment is the fastest-growing part of the recycled polyethylene terephthalate market due to its increasing use in non-food applications such as textiles, automotive parts, and industrial packaging. Colored rPET is more affordable than clear rPET and is suitable for products where appearance is less important. As industries look for cost-effective and eco-friendly materials, colored rPET is becoming a popular choice. Its growing acceptance in various sectors is helping this segment expand quickly in the global market.

End-Use Insights

The fibers segment is the dominant end-use segment in the recycled polyethylene terephthalate market because a large portion of recycled PET is used to produce polyester fibers for textiles. These fibers are widely used in clothing, home furnishings, carpets, and automotive upholstery due to their durability and low cost. The fashion and textile industries prefer rPET fibers as a sustainable alternative to virgin polyester. Increasing demand for eco-friendly fabrics and growing awareness of circular fashion further support the dominance of this segment.

The food and beverage containers and bottles segment is the fastest-growing end-use segment in the recycled polyethylene terephthalate market due to increasing demand for sustainable packaging solutions. rPET is widely used to produce bottles and containers for water, soft drinks, juices, and packaged foods because it is safe, lightweight, and recyclable. Leading brands are adopting rPET packaging to meet environmental goals and comply with regulations on recycled content. Growing consumer awareness and preference for eco-friendly products further fuel the rapid growth of this segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Market:

- In July 2025, Mediacor signed a collaboration with Amcor plc, a packaging company, to introduce a Two-liter spouted stand-up bag for liquids that is suitable for recycling in Austria, Germany, and Italy. The recently introduced packaging solution comes from the Nana brand from which sells eco-friendly cleaning supplies.

- In June 2025, Uflex, a flexible packaging company, revealed the introduction of a single-pellet solution that complies with FSSAI regulations for using recycled PET in packaging for food. This creative product combines virgin and recycled PET into a single pellet, similar to simplifying the procedure for the use of recycled materials in their packaging in order to comply with the Extended Guidelines for Producer Responsibility.

- In March 2025, Borealis GmbH, a chemicals company, revealed the launch of the Borcycle M CWT120CL, linear low-density polyethylene (rLLDPE) that has been recycled 85% post-consumer recyclable, made for flexible packaging applications other than food.

Access our exclusive, data-rich dashboard dedicated to the Recycled Polyethylene Terephthalate (rPET) Market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is your one-stop solution and strategic gateway to navigating the global rPET market with confidence.

Access Now: https://www.towardspackaging.com/contact-us

Recycled Polyethylene Terephthalate Market Players

- Placon

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Indorama Ventures Public Ltd.

- Zhejiang Anshun Pettechs Fibre Co., Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Phoenix Technologies

- Libolon

- Biffa

Recycled Polyethylene Terephthalate Market Segments

By Source

- Bottles and Containers

- Films and Sheets

- Others

By Grade

- Grade A

- Grade B

By Form

- rPET Flakes

- rPET Chips

By Product

- Clear

- Colored

By End-Use

- Fibers

- Films and Sheets

- Strapping

- Food and Beverage Containers and Bottles

- Non-Food Containers and Bottles

- Others

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

-

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5649

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Web Wire | Packaging Web Wire | Automotive Web Wire

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.