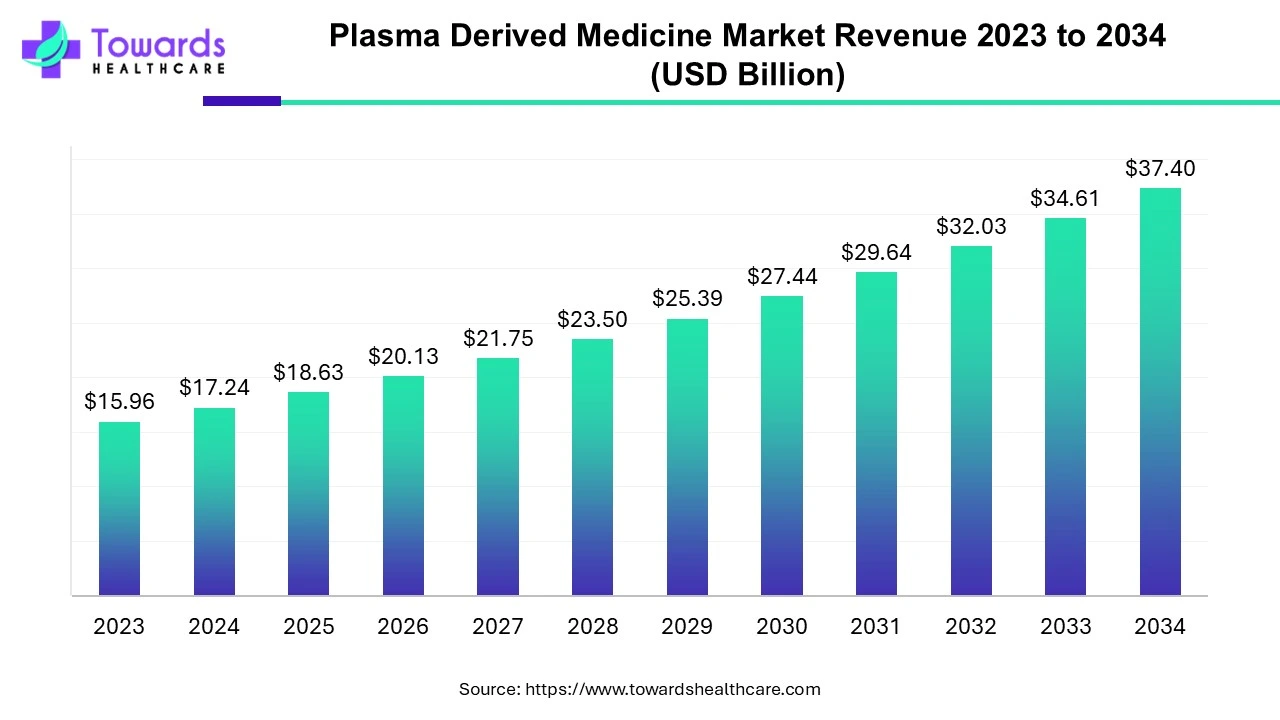

Plasma Derived Medicine Market to Reach USD 37.4 Billion by 2034, Growing at 8.05% CAGR

The global plasma derived medicine market size is calculated at USD 18.63 billion in 2025 and is expected to reach around USD 37.4 billion by 2034, growing at a CAGR of 8.05% for the forecasted period.

Ottawa, Aug. 07, 2025 (GLOBE NEWSWIRE) -- The global plasma derived medicine market size was valued at USD 17.24 billion in 2024 and is predicted to hit around USD 37.4 billion by 2034, a study published by Towards Healthcare a sister firm of Precedence Research.

The growth of the market is driven by the growing demand for therapies for the treatment of rare and immune disorders, which supports the growth of the market.

Get a glimpse into key trends, insights, and data shaping the plasma-derived medicine market: https://www.towardshealthcare.com/download-sample/5302

Key Takeaways

- North America is dominant in the plasma-derived medicine market share in 2023.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the immunoglobin segment held the largest share of the market in 2023.

- By product, the coagulation factors segment is anticipated to grow significantly during the forecast period.

- By application, the bleeding disorders segment held the largest share of the market in 2023.

- By distribution channel, the hospital pharmacies segment led the market in 2023.

- By distribution channel, the online pharmacies segment is estimated to grow rapidly in the plasma-derived medicine market during the forecast period.

Market Overview & Potential

Plasma-derived medicinal products (PDMPs) are pharmaceuticals made from human blood plasma. These include albumin, coagulation factors, and immunoglobulins, which are vital for treating serious conditions like bleeding disorders, immune deficiencies, and rare diseases. PDMPs come from donated plasma, which is processed to isolate specific proteins or substances used in therapy.

What Drives the Growth of the Plasma-Derived Medicine Market?

The market is expanding mainly due to the increasing prevalence of chronic diseases such as hemophilia and immune disorders, a rise in global plasma donations, and advances in biotechnology. These factors boost demand for plasma-derived treatments, complemented by supportive regulations and strategic actions by key companies. The need for coagulation factors from plasma is high because of the chronic nature of these illnesses. Improved plasma separation and fractionation techniques are also contributing. Ongoing research uncovers new uses for plasma medicines, broadening the market.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Trends Are Shaping the Plasma-Derived Medicine Market?

Growing Incidence of Chronic and Rare Diseases: Diseases like hemophilia, immune deficiencies, and liver conditions are increasingly treated with plasma therapies.

Rising Geriatric Population: Older adults are more prone to chronic illnesses, driving higher demand.

Advances in Plasma Fractionation: Newer, better methods to separate and purify plasma components have expanded treatment options.

Government Support and Reimbursement Policies: Policies and reimbursement schemes in various regions bolster market growth.

Increasing Demand for Immunoglobulins: Immunoglobulins, crucial for managing primary immunodeficiency and neurological disorders, constitute a key market segment.

What Is the Growing Challenge in the Plasma-Derived Medicine Market?

The market encounters several major challenges, such as elevated production costs, intricate regulatory requirements, supply chain fragility, and ethical issues surrounding plasma collection. Moreover, there is competition from synthetic alternatives and a continuous demand for increased plasma collection, particularly outside the US.

Regional Analysis

How Did North America Dominate the Plasma-Derived Medicine Market in 2024?

North America held a leading share in the market in 2023, driven by several factors. The region benefits from advanced healthcare infrastructure, providing high-quality care to its population. Key market players regularly invest in R&D, innovation, and collaborations to enhance product offerings. Additionally, government and non-government organizations allocate resources to support clinical trials, research, awareness, and healthcare initiatives to strengthen the healthcare system.

Citizens are generally aware of their healthcare rights and effectively utilize available resources, often supported by health insurance that encourages the use of proper health services. Campaigns promoting blood donation and awareness about its importance motivate participation in blood donation programs. The growth of the blood plasma-derived medicine market is primarily fueled by contributions from the U.S. and Canada.

The U.S. faces increasing demand for plasma-derived medicines due to a growing prevalence of immune deficiencies and rare diseases. Aging populations and advanced diagnostic capabilities also drive usage. Additionally, the country is a major plasma collector and producer, ensuring availability and encouraging broader therapeutic application across hospitals and specialized treatment centers.

Canada’s rising use of plasma-derived medicines is fueled by increased awareness of immunodeficiencies and neurological disorders. Government support for self-sufficiency in plasma supply enhances local production. Import reliance has spotlighted supply chain vulnerabilities, prompting expanded domestic use and advocacy for improved access and treatment outcomes in both urban and remote regions.

What Caused Rapid Growth in the Asia Pacific Plasma-Derived Medicine Market in 2024?

Asia Pacific is projected to register the fastest CAGR during the forecast period. The region's market expansion is driven by increasing awareness of blood donation. Governments and NGOs are conducting numerous campaigns and awareness programs to promote blood donation. The rise in the number of blood banks ensures timely access to blood products like plasma-derived medicines. Furthermore, many key players are expanding plasma-derived product production to meet the growing demand caused by rising disease prevalence. Major contributors to this growth include China, India, Japan, and South Korea.

China’s plasma-derived medicine usage is expanding due to improved healthcare access, increasing diagnosis of rare diseases, and an aging population. Government healthcare reforms and investment in biotechnology support growth. Public health initiatives promote awareness and early treatment, while domestic companies scale up plasma collection and manufacturing capabilities to meet demand.

India’s growing usage of plasma-derived medicines is driven by expanding healthcare infrastructure and better diagnosis of conditions like hemophilia and immunodeficiencies. Rising middle-class income and insurance coverage improve access. Additionally, awareness campaigns and partnerships with global firms support availability, while local production is increasing to reduce dependence on imports.

- According to Volza's Global Export data, the World shipped out 6,518 Blood Plasma shipments from October 2023 to September 2024 (TTM). These exports were handled by 243 global exporters to 230 buyers, showing a growth rate of 76% over the previous 12 months.

- Globally, India, the United States, and Russia are the top three exporters of Blood Plasma. India is the global leader in Blood Plasma exports with 7,677 shipments, followed closely by the United States with 3,398 shipments, and Russia in third place with 226 shipment.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By product,

The immunoglobin segment held the largest share of the plasma-derived medicine market in 2023. Immunoglobulin is the leading product segment in the market, widely used to treat primary immunodeficiency, autoimmune disorders, and neurological conditions. Available in intravenous (IVIG) and subcutaneous (SCIG) forms, it plays a critical role in modulating the immune response. Rising diagnosis rates, aging populations, and increasing use of off-label therapies are driving demand. Advancements in plasma fractionation and expanded clinical indications continue to strengthen market growth for immunoglobulin therapies.

The coagulation factors segment is anticipated to grow significantly during the forecast period. Coagulation factors are essential plasma-derived products used primarily in the treatment of bleeding disorders such as hemophilia A and B. Products like Factor VIII and Factor IX restore normal clotting function in affected individuals. Increasing awareness, improved diagnostic capabilities, and national treatment programs are driving demand. Ongoing research, along with government support for rare disease management, is expanding access and fueling growth in the coagulation factors segment globally.

By application,

The bleeding disorders segment held the largest share of the plasma-derived medicine market in 2023. Bleeding disorders represent a major application segment in the market, with treatments focused on conditions like hemophilia, von Willebrand disease, and rare clotting factor deficiencies. Plasma-derived coagulation factors are critical for preventing and managing bleeding episodes. Rising awareness, newborn screening, and government-backed hemophilia care programs are improving diagnosis and treatment rates. Continuous innovation in factor concentrates and home-based therapies is further supporting segment growth and patient quality of life.

By distribution channel,

The hospital pharmacies segment led the plasma-derived medicine market in 2023. Hospital pharmacies are a primary distribution channel for plasma-derived medicines, ensuring controlled and timely access to critical therapies like immunoglobulins, albumin, and coagulation factors. These pharmacies support inpatient and outpatient care for complex conditions such as immune deficiencies and bleeding disorders. The presence of trained medical staff, cold chain storage, and reimbursement support makes hospitals the preferred setting for administration. Increasing hospital admissions and specialized treatment centers are driving the growth.

The online pharmacies segment is estimated to grow rapidly in the plasma-derived medicine market during the forecast period. Online pharmacies are emerging as a convenient distribution channel for plasma-derived medicines, particularly for chronic conditions requiring regular treatment, such as immunodeficiencies. They offer home delivery, digital prescriptions, and subscription models for therapies like IVIG and albumin. Growth is supported by increasing digital healthcare adoption, improved logistics, and patient preference for doorstep services. However, strict regulatory compliance and cold chain management remain crucial challenges for safe and reliable distribution, which supports growth.

Recent Developments in the Plasma-Derived Medicine Market

- In December 2024, according to Jörg Schüttrumpf, chief scientific innovations officer, Grifols intends to publish the Phase III findings of their long-term albumin therapy 2024. This medication lengthens the life period for patients with decompensated cirrhosis and ascites.

- In June 2024, CSL Behring, a division of the world's leading biotechnology company, is the manufacturer of Haemocomplettan P (Human Fibrinogen Concentrate), which was recently introduced by Bengaluru-based Plasmagen Biosciences, which specializes solely in Plasma Protein and Specialty Care Therapy.

Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting

Top Companies and Their Contributions to the Market

| Company | Contributions and Offerings |

| Biotest AG | Biotest specializes in immunology and hematology, offering products like immunoglobulins and coagulation factors. It focuses on treating immune deficiencies and liver diseases. |

| Kameda Pharmaceuticals | Based in Japan, Kameda focuses on plasma-derived albumin and immunoglobulin therapies. It supports domestic plasma fractionation and is expanding its export footprint. |

| ADMA Biologics | ADMA develops immunoglobulin therapies, especially for immune-compromised patients. Its FDA-approved products include Bivigam and ASCENIV, used for treating respiratory infections. |

| Shanghai RAAS | A leading Chinese firm, Shanghai RAAS produces albumin, immunoglobulins, and coagulation factors. It has a large domestic distribution network and focuses on modernizing plasma technology. |

| Kedrion | An Italian-based company, Kedrion manufactures plasma-derived products for hemophilia, immune disorders, and other rare diseases. It partners with governments to improve access. |

| China Biologic Products Holdings | This company supplies albumin, IVIG, and clotting factors in China. It invests heavily in R&D and plasma collection, strengthening China’s self-reliance in biotherapeutics. |

| Bio Products Laboratory (BPL) | BPL produces specialty plasma products including coagulation factors and immunoglobulins. It serves global markets with facilities in the UK and the U.S. |

| CSL Limited | CSL, through CSL Behring, is a global leader in plasma therapies. Its portfolio includes treatments for hemophilia, immune deficiencies, and neurological conditions. |

| Octapharma AG | Octapharma produces human proteins from plasma and recombinant technologies. Key offerings include albumin, IVIG, and coagulation factor therapies for global distribution. |

| LFB | A French biopharmaceutical company, LFB develops plasma-derived treatments for rare diseases, focusing on immunology, hemostasis, and intensive care. |

Plasma Derived Medicine Market Key Players List

- Biotest AG

- Kameda Pharmaceuticals

- ADMA Biologics

- Shanghai RAAS

- Kedrion

- China Biologic Products Holdings

- Bio Products Laboratory

- CSL Limited

- Octapharma AG

- LFB

- Takeda

- Fusion Healthcare

- SK Plasma

- Grifols, S.A

Browse More Outlooks of Towards Healthcare in Plasma & Related Segments

-

Specialty Control Plasma Market

The global specialty control plasma market is valued at USD 10.42 billion in 2024, expected to reach USD 11.09 billion in 2025, and is projected to grow significantly to around USD 19.42 billion by 2034. This growth reflects a CAGR of 6.44% between 2025 and 2034, driven by the increasing demand for high-quality control plasma in clinical diagnostics and laboratories. -

Plasma Fractionation Market

The plasma fractionation market was estimated at USD 32.75 billion in 2023 and is projected to reach USD 72.86 billion by 2034, expanding at a CAGR of 7.54%. This growth is attributed to the rising use of plasma-derived therapies in treating immune deficiencies, bleeding disorders, and other chronic conditions. -

Blood Bank & Plasma Freezer Market

The blood bank and plasma freezer market was valued at USD 95 million in 2023 and is anticipated to grow to USD 168.36 million by 2034, with a CAGR of 5.34%. The market is gaining traction due to the need for temperature-controlled storage systems in hospitals and research labs. -

Plasma Protein Products Market

In 2023, the plasma protein products market was worth USD 32.8 billion, and it's projected to nearly double, reaching USD 72.9 billion by 2034, registering a CAGR of 7.53%. Increased usage of albumin, immunoglobulins, and coagulation factors in therapeutic areas is fueling this market. -

Plasma Fraction Market

The plasma fraction market, valued at USD 32.75 billion in 2023, is expected to grow to USD 72.86 billion by 2034, at a CAGR of 7.54%. This segment continues to grow in parallel with advancements in plasma-derived medicinal products. -

Blood Plasma Freezer Market

The blood plasma freezer market was estimated at USD 542 million in 2023 and is set to grow to USD 903.01 million by 2034, reflecting a CAGR of 4.75%. Growth in this space is fueled by the expansion of plasma collection centers and biobanking infrastructure. -

Blood Plasma Fractionation Market

The blood plasma fractionation market stood at USD 30.93 billion in 2023 and is forecasted to reach USD 74.74 billion by 2034, growing at a notable CAGR of 8.35%. Increased applications in treating rare diseases and growing R&D investments are driving market expansion. -

Precision Medicine Market

The precision medicine market is witnessing significant momentum, with a market size of USD 101.86 billion in 2024, expected to rise to USD 118.52 billion in 2025, and reaching approximately USD 463.11 billion by 2034. The market is growing at a strong CAGR of 16.35% between 2025 and 2034, as demand surges for personalized therapies based on genetics and molecular profiling. -

Photomedicine Market

The global photomedicine market was valued at USD 4.99 billion in 2023 and is projected to reach USD 10.22 billion by 2034, growing at a CAGR of 6.74%. The market is expanding due to wider adoption of light-based therapies in dermatology, oncology, and ophthalmology. -

Acne Medicine Market

In 2023, the acne medicine market stood at USD 13.44 billion and is expected to reach USD 23.33 billion by 2034, growing at a CAGR of 5.14%. Increasing cases of acne across all age groups and advancements in topical and systemic treatments are boosting market growth.

Segments Covered in The Report

By Product

- Immunoglobin

- Coagulation Factors

- Albumin

- Others

By Application

- Bleeding Disorders

- Alpha-1 Antitrypsin Deficiency (AATD)

- Pelvic Inflammatory Disease (PID)

- Hereditary Angioedema (HAE)

- Chronic Inflammatory Demyelinating Polyneuropathy

- Guillian=Barre Syndrome

- Multifocal Motor Neuropathy

- Liver Disease

- Primary Immune Thrombocytopenia

- Infections

- Other Orphan Diseases

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

To invest in our premium strategic solution and customized market report options, click here: https://www.towardshealthcare.com/price/5302

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.