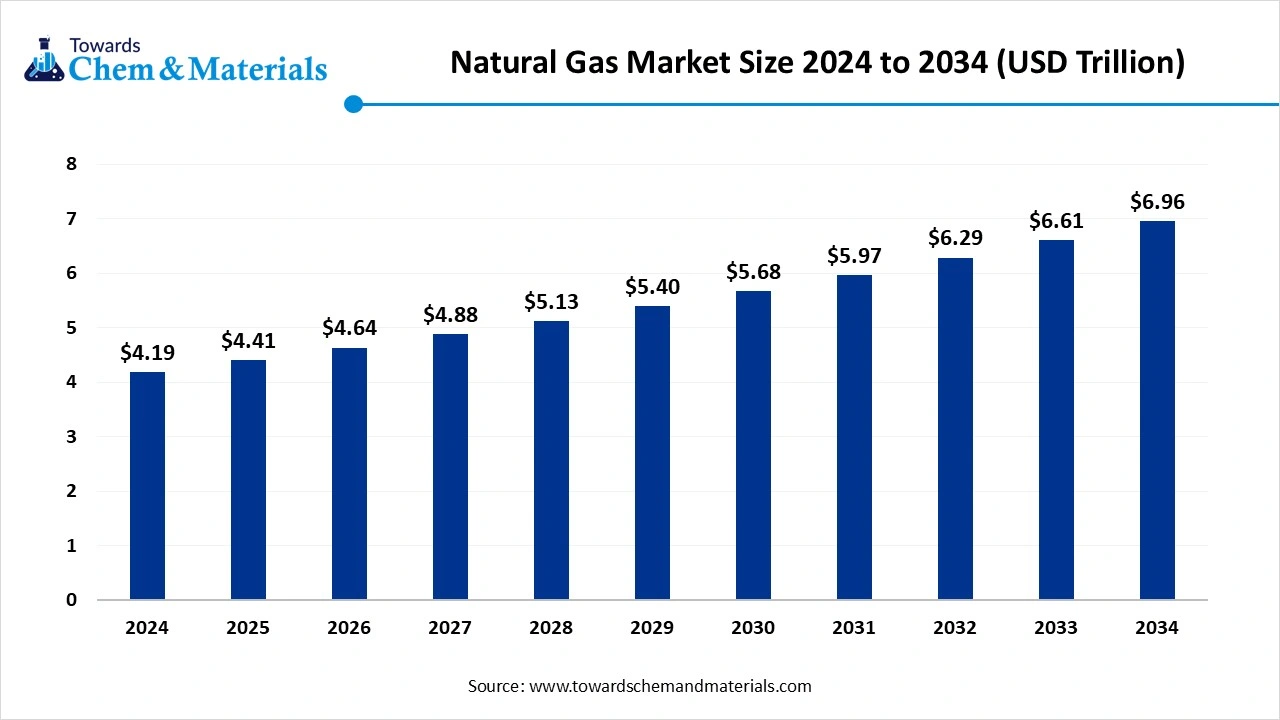

Natural Gas Market Size to Hit USD 6.96 Trillion by 2034

According to Towards Chemical and Materials, the global natural gas market size was valued at USD 4.19 trillion in 2024 and is expected to hit around USD 6.96 trillion by 2034, growing at a compound annual growth rate (CAGR) of 5.20% over the forecast period from 2025 to 2034.

Ottawa, Aug. 07, 2025 (GLOBE NEWSWIRE) -- The global natural gas market size is calculated at USD 4.19 trillion in 2024, grew to USD 4.41 trillion in 2025, and is projected to reach around USD 6.96 trillion by 2034. The market has a sustained growth trajectory as demand increasingly rises from LNG exports, electricity usage from data centres, and use in the power and industrial sectors. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5634

Natural Gas Market Overview

Natural gas is a fossil fuel primarily made up of methane, which is used as a clean-burning fuel source for electricity production, heating, and industrial uses, and it is a primary feedstock in the production of chemicals and fertilizers.

The natural gas markets are driven by global demand for cleaner alternatives to existing fossil fuel energy sources, by rising electricity demand, and the increasing use of natural gas in transportation and industry. Developments in liquefied natural gas (LNG) technology and pipeline infrastructure developments are facilitating market trade opportunities between countries. While North America is generally the largest producer, in terms of consumer markets, Asia Pacific with its wok and rising energy needs and with a focus on how to replace coal with cleaner fuel sources, is the fastest growing consumer market.

Natural Gas Market Major Trends?

- Growth in LNG Trade- The demand for flexible, cross-border energy supply is driving investment in LNG terminals, which will allow access to, and logistics for, natural gas on a much larger scale globally.

- Coal-to-gas Shift- Countries are moving from coal to natural gas for energy generation purposes to reduce carbon emissions - this coincides with clean energy goals of countries, as well as environmental policies framed by national government commitments to global climate agreements.

- Growth of Gas Infrastructure- The development of pipelines, storage, and distribution systems is, and will continue to further, reliable supply access and reliability, especially in emerging economies where demands for energy are exploding.

- Partnership with Renewable Energy- Natural gas is increasingly being incorporated as a back-up temporary source of fuel for intermittent renewable sources like solar and wind, while still providing low emitting gas during times of peak demand that would otherwise be higher emitting power generation sources.

Natural gas is a relatively clean-burning fossil fuel

Burning natural gas for energy results in fewer emissions of nearly all types of air pollutants and carbon dioxide (CO2) emissions than burning coal or petroleum products to produce an equal amount of energy. For comparison, for every 1 million Btu consumed (burned), more than 200 pounds of CO2 are produced from coal and more than 160 pounds of CO2 are produced from fuel oil. The clean-burning properties of natural gas have contributed to increased natural gas use for electricity generation and for fleet vehicle fuel in the United States.

Natural gas is mainly methane—a strong greenhouse gas

Some natural gas leaks into the atmosphere from oil and natural gas wells, storage tanks, pipelines, and processing plants. The U.S. Environmental Protection Agency estimates that in 2021, methane emissions from natural gas and petroleum systems and from abandoned oil and natural gas wells were the source of about 33% of total U.S. methane emissions and about 4% of total U.S. greenhouse gas emissions.1 The oil and natural gas industry takes steps to prevent natural gas leaks. The U.S. Energy Information Administration (EIA) estimates that in 2022, U.S. CO2 emissions from burning natural gas for energy accounted for about 35% of total U.S. energy-related CO2 emissions.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5634

Natural Gas Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 4.41 Trillion |

| Revenue forecast in 2034 | USD 6.96 Trillion |

| Growth rate | CAGR of 5.20% from 2025 to 2034 |

| Actual data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Resource Type, By End-Use Application, By Distribution Method, By Region |

| Key companies profiled | ExxonMobil, Chevron, Royal Dutch Shell, TotalEnergies, BP, Gazprom, Qatar Petroleum, ONGC (Oil and Natural Gas Corporation), Reliance Industries Limited,Eni S.p.A., ConocoPhillips, Equinor, Petronas, Sempra Energy. |

Elevate your Chemical strategy with Towards Chemical and Materials. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardschemandmaterials.com/schedule-meeting

Growth Factor

Will Surge in Power Generation Demand Fuel Natural Gas Market Expansion?

A significant global driver of the natural gas market is the rapid growth in gas-fired electricity generation as evidenced by the U.S. Energy Information Administration (EIA) and the International Energy Agency (IEA) reports post-2023. In the same year, total natural gas consumption in the U.S. increased approximately 1% to 89.4 billion cubic feet per day (Bcf/d), including a 6.7% increase (2.2 Bcf/d) in the electric power sector accounting for nearly 40% of total gas consumption.

On a global scale, the IEA reported that industry and power sectors contributed approximately 75% to incremental gas demand growth as gas demand for electricity generation increased by nearly 2.8% year-on-year in 2024. heatwaves in China, India, and the U.S. resulted in spikes in gas burn for power grid stability in the summer of 2024. As governments and grid operators continue to use natural gas to balance variable renewables and energy security and the global demand for natural gas remains elevated, it is clear that power generation remains a critical driver of expansion in the natural gas market.

Market Opportunity

Is the Surge in LNG Infrastructure Opening Global Growth Avenues for Natural Gas?

There are substantial opportunities in the natural gas space based on rapid growth in liquefied natural gas (LNG) infrastructure, as there is increasing demand for energy worldwide, along with shifts in geopolitical factors. Countries that were historically reliant on Russian pipeline supply, such as Germany, Poland, and Finland, have started to fast-track the construction of LNG terminals to expand their energy sources.

-

For Instance, In May 2025, The Wilhelmshaven 02 FSRU, developed by Deutsche Energy Terminal (DET), was fully integrated into the grid in approximately 2.5 years and was subsequently incorporated into Germany's gas grid rapid timing.

At the same time, India and Asian countries are also building small-scale networks in coastal and industrial areas to make investments in LNG. Overall, this effort to build out LNG infrastructure indicates they will be a source of long-term demand for natural gas supply, storage, transport, and technology and that LNG will continue to be a central consideration in energy strategies globally.

You can place an order or ask any questions, please feel free to contact at sales@towardschemandmaterials.com| +1 804 441 9344

Natural Gas Market Segmentation

Resource Type Insights

Why Is Unconventional Resource Dominated the Natural Gas Market in 2024?

The unconventional resource segment dominates the natural gas market in 2024. This included sources, such as shale gas, tight gas, and coalbed methane. This segment's development has primarily been supported by new extraction techniques, such as hydraulic fracturing and horizontal drilling that have increased the recoverability of unconventional reserves. In addition, growing energy supplies and the global transition to cleaner fuels have all supported an increase in natural gas production from these resources, with North America and Asia being particularly important for others to gauge.

The liquefied natural gas (LNG) segment expects the fastest growth during forecast period. LNG's flexibility in long-distance transportation and storage allows it to be an important, efficient segment of global energy trade. Countries without infrastructure for transporting natural gas in pipelines are turning to imports of LNG to fulfill their energy needs. Therefore, the segment continues to grow and expand as new LNG terminals open and there continues to be an investment in production and export facilities, especially the U.S., Qatar, and Australia, all contributing to this segment's rapid expansion in international markets.

End Use Application Insights

Which End Use Application Segment Dominates the Natural Gas Market in 2024?

The power generation segment dominated the natural gas market in 2024, as nations around the world continue to focus on moving towards a cleaner energy mix. Natural gas is widely deployed in power plants because it generates fewer carbon emissions than coal and oil. Efficiency has also been improved with the introduction of combined cycle gas turbine technology. Hence, natural gas is fuelling electricity generation in both developed and developing countries.

The residential segment expects the fastest growing in the forecast period. This is largely driven by increasing population urbanization rates, increasing gas distribution systems and favourable government policies promoting the use of natural gas for cooking and household heating. Several countries, especially those in Asia and the Middle East, have invested in increasing piped natural gas networks to allow residences to access natural gas for homes, causing increased demand for this segment.

Distribution Method Insights

Why Pipeline is the Dominant Distribution Method for Natural Gas Market in 2024?

The pipeline segment held the largest market share in 2024. There are significant advantages of pipelines, such as offering large-scale, consistent, and cost-effective transportation of natural gas. Pipeline infrastructure is at the center of the development within the domestic and cross-border energy supply chains, especially in North America, Europe, and some parts of Asia. The reliability, lower operational costs, and the ability to backup energy security has led to extensive use of pipelines.

The LNG carrier segment is expected to experience the fastest growth throughout the forecast period. As the global demand for liquefied natural gas continues to grow, there are many countries investing heavily in LNG shipping fleets that are backed by LNG storage infrastructure. LNG carriers are well-suited for the longer-distance and varied transport of natural gas to regions that do not have a pipeline infrastructure to access it. Due to the rising involvements in international trading of LNG, especially from the U.S., Qatar, and Australia to countries in the Asia-Pacific and Europe regions, it is expected to be a very productive growth area.

Regional Insights

Why Did Asia Pacific Dominate the Natural Gas Market in 2024?

Asia Pacific dominated the natural gas market in 2024 due to unparalleled energy demand, a growing industrial base, and an increasing commitment to moving beyond coal dependency. To meet demands, the region has substantial investments into LNG infrastructure, pipeline development, and a diversification of energy imports to guarantee energy security. The region's energy and natural gas consumption has increased across the board in response to urbanization, population growth, and economic growth from many countries investing in energy-related infrastructure and support of financial decisions. In addition to developing gas infrastructure, long-term ordering contracts with numerous LNG suppliers along with supportive governmental practices have secured the largest local natural gas buyer's future gas supply.

Market Trends in China

China has taken the lead in developing a natural gas market because of its significant decarbonization plan and existing industrial demand. China is continuing with its effort to improve the city gas distribution system, underground gas storage, and LNG terminals. The National Energy Administration has made clear through planning documentation that they consider natural gas to be a transitional fuel towards reducing coal dependency and improving air pollution and quality for the broader populations and regions. There is significant residential use expansion, new partnership development with natural gas exporters alongside government subsidies for clean energies, sustaining gas demand as a key driver for China and the larger Asia Pacific region's new consumption based.

-

In March 2025, Woodside Energy signed a long-term contract with China Resources Gas for providing 0.6 million metric tonnes of LNG per year to China and the agreement begins in 2027. This agreement bolsters the position of Australia in China’s burgeoning LNG import market alongside emerging energy security issues.

Why North America showing up as the Fastest Growing Region in Natural Gas Market?

North America expects the fastest growth in the natural gas market during the forecast period, fueled by technological advances, abundant shale gas reserves, and improved LNG infrastructure. North America has seen a growth of tens of millions of cubic feet of production capacity, especially in the United States and Canada, because of hydraulic fracturing technology and the expanding use of horizontal drilling Natural gas is being used for additional purposes in industrial heating, large-scale transportation including truck and rail, and even residential energy applications that will continue to foster development in the market within the region.

Market Trends the U.S.

The U.S. remains the center of the growth with LNG export capacity expected to increase further, with unprecedented production and export capabilities. According to data from the U.S. Energy Information Administration (EIA) In April 2025, for the fourth month in five months, dry natural gas production year over year (y/y) growth, hit a record 107.2 billion cubic feet per day (Bcf/d), a 5.4% (5.5 Bcf/d) increase compared to April 2024.

Continued growth is expected given the strong demand in domestic and export markets. Natural gas is a critical component energy source in the U.S. energy mix with utilities transitioning to lower emitting fuels and using natural gas for a significant portion of its power generation production. Long-term supply contracts for LNG, from producers for Europe and Asia have resulted in the U.S. attaining a leading position in energy exports globally, supporting the impetus for North America's growth in natural gas.

More Insights in Towards Chemical and Materials:

- Renewable Natural Gas Market : The global renewable natural gas market size was accounted for USD 14.33 billion in 2024 and is expected to be worth around USD 31.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.15% during the forecast period 2025 to 2034.

- Oil & Gas Infrastructure Market : The global oil & gas infrastructure market size was reached at USD 752.19 billion in 2024 and is expected to be worth around USD 1,377.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034.

- Gas Separation Membrane Market : The global gas separation membrane market size was valued at approximately USD 1.85 billion in 2024 and is projected to grow at a CAGR of 6.95% from 2025 to 2034, reaching a value of USD 3.62 billion by 2034.

- Oil & Gas Market : The global Oil & Gas-market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034.

- Natural Fiber Market ; The global natural fiber market size surpassed USD 73.55 billion in 2025 and is estimated to hit around USD 123.21 billion by 2034 growing at a CAGR of 5.9% from 2025 to 2034.

- Natural Aroma Chemicals Market : The global natural aroma chemicals market size was reached at USD 4.55 billion in 2024 and is estimated to surpass around USD 5.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.65% during the forecast period 2025 to 2034.

- Natural Ferulic Acid Market : The global natural ferulic acid market size was reached at USD 14.82 billion in 2024 and is expected to hit around USD 30.40 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.45% during the forecast period 2025 to 2034.

- U.S. Oil & Gas Market : The U.S. oil & gas market volume is calculated at USD 1.55 trillion in 2024, grew to USD 1.61 trillion in 2025, and is projected to reach around USD 2.24 trillion by 2034. The market is expanding at a CAGR of 3.75% between 2025 and 2034.

- Europe Oil & Gas Infrastructure Market : The global Europe oil & gas infrastructure market size was reached at USD 85.11 billion in 2024 and is expected to be worth around USD 140.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034.

- Transparent Ceramics Market : The global transparent ceramics market size was reached at USD 619.40 million in 2024 and is expected to be worth around USD 2,409.47 million by 2034, growing at a compound annual growth rate (CAGR) of 14.55% over the forecast period 2025 to 2034.

- Asia Pacific Oil & Gas Infrastructure Market : The Asia Pacific oil & gas infrastructure market size accounted for USD 207.77 billion in 2025 and is forecasted to hit around USD 365.90 billion by 2034, representing a CAGR of 6.49% from 2025 to 2034.

- High-Temperature Insulation Materials Market : The global high-temperature insulation materials market size was reached at USD 9.11 billion in 2024 and is expected to be worth around USD 16.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034.

Natural Gas Market Top Key Companies:

- ExxonMobil

- Chevron

- Royal Dutch Shell

- TotalEnergies

- BP

- Gazprom

- Qatar Petroleum

- ONGC (Oil and Natural Gas Corporation)

- Reliance Industries Limited

- Eni S.p.A.

- ConocoPhillips

- Equinor

- Petronas

- Sempra Energy

Natural Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Natural Gas Market

By Resource Type

- Conventional Natural Gas

- Unconventional Natural Gas (Shale Gas, Tight Gas, Coalbed Methane)

- Liquefied Natural Gas (LNG)

By End-Use Application

- Power Generation

- Industrial Use

- Residential

- Commercial

- Transportation

By Distribution Method

- Pipelines

- LNG Carriers

- Compressed Natural Gas (CNG)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5634

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.