Oleochemicals Market Size Worth USD 52.88 Bn by 2034

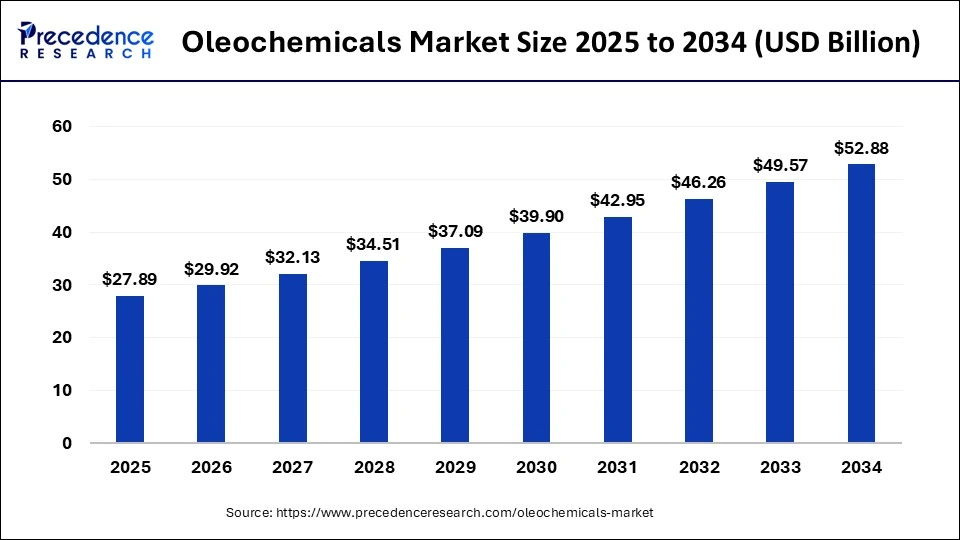

According to Precedence Research, the global oleochemicals market size is expected to be worth USD 52.88 billion by 2034 increase from USD 27.89 billion in 2025. The market is growing at a CAGR of 7.35% from 2025 to 2034. Key drivers include the demand for green chemistry, favorable government policies, and rising use in cosmetics, lubricants, food, and healthcare sectors.

Ottawa, Aug. 07, 2025 (GLOBE NEWSWIRE) -- The oleochemicals market size has been evaluated at USD 27.89 billion in 2025 and is projected to rise from to reach USD 29.92 billion in 2025 to approximately USD 52.88 billion by 2034. The emerging need to incorporate renewable resources that are biodegradable and have lower environmental impact raises the importance of oleochemical compounds.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1693

Global Oleochemicals Market – Key Highlights

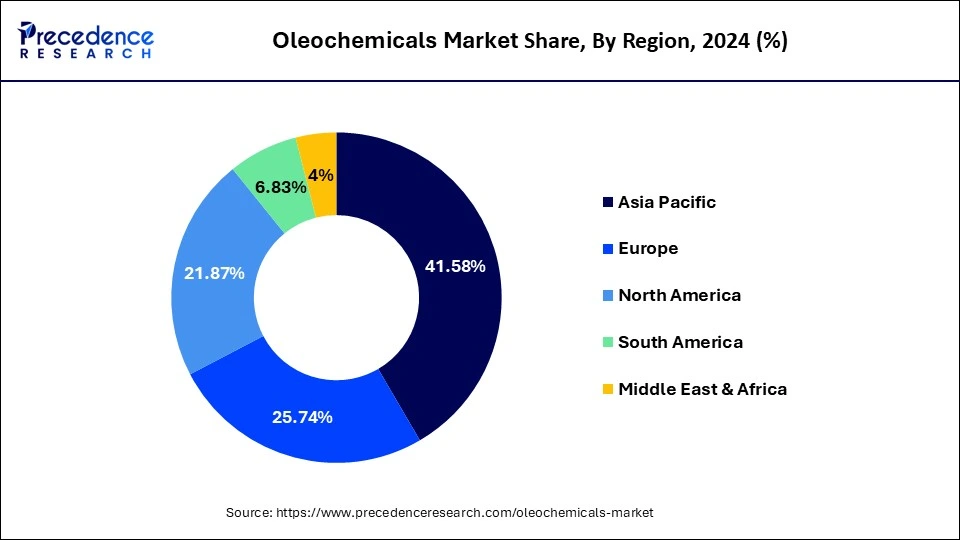

- Asia Pacific led the market in 2024, emerging as the dominant regional player in terms of revenue and production.

- North America is projected to witness the fastest CAGR during the forecast period, driven by growing demand across multiple industries.

By Product:

- Specialty esters held the largest market share in 2024, owing to their wide industrial applicability.

- Fatty acid methyl esters are anticipated to grow at the highest CAGR, fueled by their increasing use in biodiesel and environmental-friendly solutions.

By Application:

- The industrial segment was the leading application segment in 2024, supported by demand in lubricants, surfactants, and manufacturing.

- The personal care & cosmetics segment is expected to expand at the fastest CAGR, attributed to rising consumer preference for bio-based ingredients.

By Form:

- Liquid form dominated the market in 2024, due to ease of handling and blending in formulations.

- Solid form is forecast to register the fastest CAGR, especially in sectors requiring longer shelf life and easy transportation.

By Feedstock:

- Palm oil was the dominant feedstock in 2024, benefiting from its high yield and cost-effectiveness.

- Soy-based oleochemicals are expected to grow at the fastest CAGR, owing to sustainable sourcing trends and government support in certain regions.

"The global shift toward circular and bio-based economies has made oleochemicals a critical component in multiple value chains," said Saurabh Bidwai, Principal Consultant at Precedence Research. "Players that innovate around sustainable sourcing and green technologies will dominate this decade.”

Oleochemicals Market Overview and Industry Potential

What are Oleochemicals?

Oleochemicals refer to the chemical compounds derived from fats and oils that are majorly used in various industries and as the best alternative to petrochemicals. They are safer options than their synthetic chemical alternatives and are produced by various chemical processes. The most used oleochemicals in industrial applications and in the global market are palm oil, soy, and coconut oil.

With the rising prices of crude oil and affordability concerns related to plant-based lauric oil, manufacturers shifted from petrochemicals to oleochemicals. They are widely used in applications such as personal care, coatings, cosmetics, adhesives, lubricants, pharmaceuticals, neutraceuticals, etc.

With growing concerns over petrochemical pollution and carbon emissions, oleochemicals offer an eco-friendly alternative that aligns with global sustainability goals. Their biodegradability, low toxicity, and renewability make them ideal for companies aiming to meet ESG targets.

➤ Get the Full Report @ https://www.precedenceresearch.com/oleochemicals-market

Oleochemicals Market Major Trends

What are the Recent Innovations in the Oleochemicals Industry?

-

Renewable Raw Materials: The leading companies like BASF SE are driving transformation in the market by using certified and sustainably sourced oleochemicals to deliver renewable raw materials like coconut oil. Coconut oil is widely used by these companies in the manufacturing of ingredients for products like cleaning agents, detergents, and cosmetics. The expansion of the production sites of BASF SE across Spain, Italy, Cassina Rizzardi, etc. also drives the launch of personal care products based on coconut oil.

-

Chemical Recycling of Plastics: It is a complementary technology to mechanical recycling that is used by the leading companies to reduce the amount of plastic waste that is found in landfills or thermally recovered forms. Chemical recycling breaks down plastics into basic chemicals.

How Can AI Help the Oleochemicals Industry?

Generative AI helps in creating creative processes and insights, including new molecular and marketing designs that are more customizable and accessible. AI helps companies to enhance their business operations.

Generative AI adds value across all business functions in chemicals, such as commercial, research and development, operations, and support functions. It contributes to new molecular discovery, rapid and precise formulation, and augmented knowledge extraction across the R&D sector.

For instance, BASF is exploring AI-driven R&D platforms to accelerate the development of oleochemical-based surfactants with improved performance and biodegradability.

Oleochemicals Market Opportunities

What are the Major Breakthroughs in the Chemical Industry?

- In June 2025, Aditya Birla Group announced the acquisition of a 17-acre specialty chemicals manufacturing facility of Cargill Incorporated that is situated in Dalton, Georgia. This purchase greatly strengthened the presence of Aditya Birla Chemicals (USA) Inc. with its extended investment of $15 billion in the U.S. manufacturing sector. (Source: https://www.newindianexpress.com)

- In July 2025, Godrej Industries Limited (Chemicals) announced a major expansion of its manufacturing operations with a total investment of INR 750 Crore over the next few years to accomplish the goal of becoming a global player of USD 1 billion by 2030. (Source: https://www.fuelsandlubes.com)

Oleochemicals Market Challenges and Limitations

What are the Major Concerns in Oleochemicals Logistics?

-

Supply and Demand: The crisis in the Red Sea impacted the Suez Canal, which has resulted in ship diversions around the Cape of Good Hope in South Africa. There is increased demand in some Western countries while some buyers depend on China to boost their orders.

-

Reliability: Longer journeys impact trade lanes and schedules, which are challenging factors in maintaining reliability in operations.

- Volatile raw material prices, deforestation-linked feedstock (especially palm oil), and regulatory hurdles in different regions are among the major challenges facing the industry. Balancing cost, sustainability, and performance remains a key concern for manufacturers.

Scope of Oleochemicals Market

| Report Attributes | Key Statistics |

| Market Size in 2024 | USD 26.01 Billion |

| Market Size in 2025 | USD 27.89 Billion |

| Market Size in 2030 | USD 39.90 billion |

| Market Size in 2032 | USD 46.26 billion |

| Market Size by 2034 | USD 52.88 Billion |

| Growth Rate (2025 to 2034) | CAGR of 7.35% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Application, Form, Feedstock, and Regions |

| Region Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Oleochemicals Market Key Regional Analysis

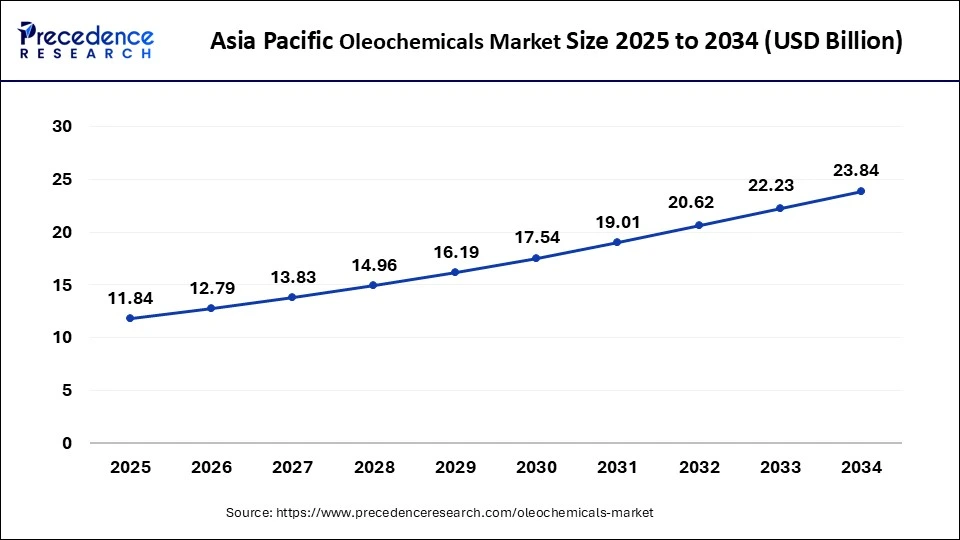

How Big is the Asia Pacific Oleochemicals Market?

The Asia Pacific specialty oleochemicals market size was valued at USD 33.39 billion in 2024, accounted for USD 36.26 billion in 2025 and is anticipated to reach around USD 76.19 billion by 2034. The market is expanding at a CAGR of 8.6% between 2024 and 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1693

How Asia Pacific Dominated the Oleochemicals Market in 2024?

Asia Pacific dominated the oleochemicals market in 2024 owing to the increased demand for sustainable and bio-based products. Niti Ayog, India participated in the global value chain by studying the chemical industries. It believes in the global value chain as the most potent driver of employment generation, enhanced productivity, and rising living standards. In October 2024, the Union Cabinet announced the approval of the national mission on edible oils-oilseeds from 2024-25 to 2030-31. These newly approved NMEO oilseeds aim to boost the production of primary oilseed crops, including soybeans, sunflowers, Sesamum, mustard, groundnuts, etc.

In July 2024, Jagat Prakash Nadda, the Union Chemicals and Fertilizers Minister, announced the Indian government's interventions to address challenges faced by chemical industries and support the growth of the chemical and petrochemicals industries. It aligns with India’s goal of becoming a USD 5 trillion economy.

In India, the government's National Mission on Edible Oils is boosting oilseed crop production, which indirectly supports domestic oleochemical feedstock supply.

What is the North American Vision for the Chemical Industry?

North America is expected to grow at the fastest CAGR in the oleochemicals market during the forecast period due to the expansion of major end-use industries such as food & beverages, pharmaceuticals, personal care & cosmetics, etc. In March 2024, the U.S. Department of Agriculture (USDA) announced the vision to make a strong bioeconomy of America through a more resilient biomass supply chain.

The U.S. EPA, under the Bipartisan Infrastructure Law & The Inflation Reduction Act, reported about the investments in America for climate adaptation, resilience, labor, workforce, and environmental justice. It also reported on American initiatives towards climate action through a greenhouse gas reduction fund, climate pollution reduction fund, methane emissions reduction program, etc.

In the U.S., growth is further catalyzed by incentives under the Inflation Reduction Act for bio-based and renewable chemical production.

Looking ahead, the oleochemicals market is expected to witness consolidation, innovation in bio-based surfactants, and expanded use in bioplastics and green solvents. Advancements in feedstock processing, AI-enabled R&D, and strategic partnerships will shape the next wave of growth.

Ready to dive deeper? Download the full report or request a personalized briefing session with our industry analysts. Explore how your business can capitalize on this growing USD 52.88 billion opportunity in bio-based chemicals.

✅ Get Region-Specific Insights: ✚ Asia Pacific | ✚ North America | ✚ Europe

➤ Contact Us: sales@precedenceresearch.com | ☎ +1 804 441 9344

Oleochemicals Market Segmentation Analysis:

Product Analysis:

How Specialty Esters Segment Dominated the Oleochemicals Market in 2024?

The specialty esters segment dominated the oleochemicals market in 2024 owing to their excellent properties such as emulsification, lubrication, thermal stability, viscosity control, etc. They also exhibit other exciting properties such as stability, biodegradability, solvency, film formation, etc. These compounds are widely used in diverse applications, including personal care, cosmetics, food industries, pharmaceuticals, coatings, adhesives, etc.

The fatty acid methyl ester segment is expected to grow at the fastest CAGR in the oleochemicals market during the forecast period due to the reduced emissions of harmful gases along with the renewable and sustainable nature of these biofuels. The use of different renewable sources like recycled cooking oil, vegetable oil, animal fats, and waste biomass to produce fatty acid methyl esters reduces dependency on fossil fuels. These approaches make these biofuels biodegradable and non-toxic by minimizing their impact on the environment.

Application Analysis:

What made Industrial the Dominant Segment in the Oleochemicals Market in 2024?

The industrial segment dominated the oleochemicals market in 2024 owing to the potential of oleochemicals as renewable and biodegradable resources, having reduced environmental impact. They exhibit diverse industrial applications due to their multifunctional properties, such as lubricants, surfactants, emulsifiers, etc.

The personal care & cosmetics segment is expected to grow at the fastest CAGR in the oleochemicals market during the forecast period due to the natural origin and sustainability of renewable resources derived from palm oil, soybean, and coconut. Oleochemicals act as emulsifiers in formulating lotions, stable creams, and makeup products.

Form Analysis:

How did the Liquid Segment Dominate the Oleochemicals Market in 2024?

The liquid segment dominated the oleochemicals market in 2024 owing to the easy handling, processing, versatility, and improved ingredient dispersion properties of oleochemical compounds. They exhibit excellent physical properties, enhanced product performance, and eco-friendliness.

The solid segment is expected to grow at the fastest CAGR in the oleochemicals market during the forecast period due to the numerous applications of solid oleochemicals in candle making, rubber, plastics, paints, coatings, and personal care. They deliver a reduced carbon footprint and lower toxicity.

Feedstock Analysis:

How Palm Segment Dominated the Oleochemicals Market in 2024?

The palm segment dominated the oleochemicals market in 2024 owing to the versatile applications of palm-based oleochemicals in making soaps, detergents, food additives, industrial lubricants, and many other products. Palm oil delivers high efficiency and productivity, which reduces production costs.

The soy segment is expected to grow at the fastest CAGR in the oleochemicals market during the forecast period due to the extensive support in agricultural sustainability and rural development. The use of soy-based products as alternatives to petrochemicals reduces dependency on non-renewable fossil fuel resources.

Related Topics You May Find Useful:

➢ Specialty Oleochemicals Market: Explore how green chemistry is transforming specialty oleochemicals across personal care and industrial applications

➢ Fats and Oils Market: See how health-conscious trends and plant-based diets are reshaping global fats and oils demand

➢ Caproic Acid Market: Discover the emerging industrial uses of caproic acid in food preservation, flavors, and animal feed

➢ Specialty Chemicals Market: Track innovation-driven growth in specialty chemicals across agriculture, electronics, and construction

➢ Bio-lubricants Market: Analyze how sustainability and performance are driving adoption of eco-friendly bio-lubricants

➢ Glycerol Market: Understand how pharma, food, and personal care sectors are fueling global glycerol consumption

➢ Bioherbicides Market: Gain insight into the rising demand for bioherbicides amid the global shift toward sustainable agriculture

Oleochemicals Market Top Companies

- Wilmar International Ltd.

- BASF SE

- Emery Oleochemicals Group

- Cargill, Incorporated

- Evonik Industries AG

- Kao Corporation

- IOI Group Berhad

- Godrej Industries

- Ecogreen Oleochemicals

- Kao Corporation

- Corbion N.V.

- Procter & Gamble (P&G Chemicals)

What is Going Around the Globe?

- In January 2024, Wilmar International in Singapore announced the construction and establishment of a $100mn plant in Uzbekistan for the production of vegetable oils, flour products, and high-protein feeds. (Source: https://daryo.uz)

- In March 2025, BASF SE reported sales of approximately €11 billion through research and innovations in novel products launched in the past five years. (Source: https://www.basf.com)

Oleochemicals Market Segments Covered in the Report

By Products

- Specialty Esters

- Glycerol Esters

- lkoxylates

- Fatty Acid Methyl Ester

- Fatty Amines

- Others

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food & Beverages

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Others

By Form

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

By Feedstock

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

By Region

North America

- U.S.

- Canada

- Mexico

Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1693

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor |Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.